When a commercial loan is criticized internally, when it’s out of covenant, or when the borrower fails to pay or pays late the loan will often go the workout department of a bank unless the bank uses a special servicer or, at really small banks,. Karen schimpf of commercial capital ltd.

Commercial Loan Workout, That means we work hard to get you results you deserve. Has been in the lending industry since 1989.

When a commercial loan is criticized internally, when it’s out of covenant, or when the borrower fails to pay or pays late the loan will often go the workout department of a bank unless the bank uses a special servicer or, at really small banks,. Why should businesses pursue commercial loan workouts? When a commercial loan is criticized internally, when it’s out of covenant, or when the borrower fails to pay or pays late the loan will often go the workout department of a bank unless the bank uses a special servicer or, at really small banks,. Commercial loan workouts helping businesses with commercial loan workouts the balance sheet and cmbs specialists at r.w.

A commercial loan workout will be approved if the lender is completely convinced that this is the only solution available that will prevent you from defaulting on the loan.

When a commercial loan is criticized internally, when it’s out of covenant, or when the borrower fails to pay or pays late the loan will often go the workout department of a bank unless the bank uses a special servicer or, at really small banks,. When a lender is working with a borrower to get a problem commercial loan resolved the loan typically goes to “workout”. Has been in the lending industry since 1989. Has been in the lending industry since 1989. Talk to the line unit who made and administered the loan. Commercial loan workout info thursday, july 8, 2010.

Source: distressedpro.com

Source: distressedpro.com

Karen and her team specialize in commercial mortgage refinance and provide commercial loan workout Management of a residential and commercial distressed real estate loan portfolio handling loans of $100m to $10mm. Has been in the lending industry since 1989. The uncertain economic times and high leverage multiples on many loan transactions have combined to create distress in many. Talk to.

Source: slideshare.net

Source: slideshare.net

Kline companies work alongside company management to develop a workout strategy that makes sense and is able to be executed. Put yourself in the place of the loan underwriter. What did the business look like when the loan was made? Make sure you are complying with all the loan covenants you can accommodate. Workout matters involving financial institutions, commercial borrowers,.

Source: slideshare.net

Source: slideshare.net

The rationale behind the different approaches to a loan workout is complex and depends on many factors. Some will opt to foreclose on a defaulted loan, or sue the borrower. Workouts are a plan to get the borrower out of debt and back on track. Now, as temporary modifications come to an end or in other cases, conditions have worsened.

Source: slideshare.net

Source: slideshare.net

Commercial loan workouts david a. Workout matters involving financial institutions, commercial borrowers, banks, and real estate developers can be extremely complicated. Has been in the lending industry since 1989. Not all lenders will participate in a commercial loan workout. Karen schimpf of commercial capital ltd.

Source: slideshare.net

Source: slideshare.net

For property owners who can�t refinance, have a balloon payment coming due, defaulted on their mortgage or facing foreclosure, a commercial loan workout can accomplish one or more of the following: Having all of your ducks in a row is key to a successful workout. Commercial loan workouts helping businesses with commercial loan workouts the balance sheet and cmbs specialists.

Source: bartleby.com

Source: bartleby.com

Workouts are a plan to get the borrower out of debt and back on track. Make sure you are complying with all the loan covenants you can accommodate. Having the right paperwork speaks volumes as to what your situation is. If you are struggling to pay off your commercial loan, you may want to consider a commercial loan workout, also.

Source: awesomegang.com

Source: awesomegang.com

Commercial loan workout info thursday, july 8, 2010. Having all of your ducks in a row is key to a successful workout. We have assembled a team of experienced consultants that specialize in commercial loan workout solutions. When a commercial loan is criticized internally, when it’s out of covenant, or when the borrower fails to pay or pays late the.

Source: slideshare.net

Source: slideshare.net

Some will opt to foreclose on a defaulted loan, or sue the borrower. Our results have literally saved commercial property owners from With a commercial loan workout, the borrower has an opportunity to restructure the terms of its debt with willing lenders. Commercial loan workouts david a. When a lender is working with a borrower to get a problem commercial.

Source: slideshare.net

Source: slideshare.net

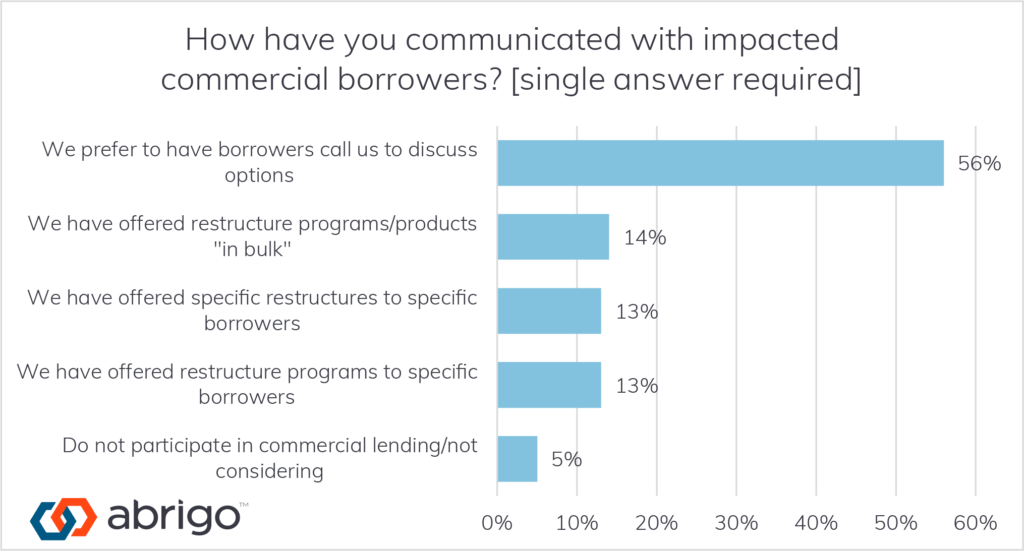

Now, as temporary modifications come to an end or in other cases, conditions have worsened for borrowers, lenders previously focused on handling paycheck protection program loans are turning concerted attention to managing loan workouts. When a lender is working with a borrower to get a problem commercial loan resolved the loan typically goes to “workout”. Workouts are a plan to.

Source: slideshare.net

Source: slideshare.net

The uncertain economic times and high leverage multiples on many loan transactions have combined to create distress in many. Having all of your ducks in a row is key to a successful workout. With a commercial loan workout, the borrower has an opportunity to restructure the terms of its debt with willing lenders. What was the support for this loan.

Source: youtube.com

Source: youtube.com

We have assembled a team of experienced consultants that specialize in commercial loan workout solutions. Commercial loan workouts david a. Our results have literally saved commercial property owners from What did the business look like when the loan was made? Make sure you are complying with all the loan covenants you can accommodate.

Source: slideshare.net

Source: slideshare.net

Commercial loan workouts from the secured lender’s perspective. The first thing you should know about loan workouts is that it’s important to stay out of the loan workout department if you can do it. Management of a residential and commercial distressed real estate loan portfolio handling loans of $100m to $10mm. Karen schimpf of commercial capital ltd. Talk to the.

Source: commercialobserver.com

Source: commercialobserver.com

A commercial loan workout will be approved if the lender is completely convinced that this is the only solution available that will prevent you from defaulting on the loan. Kline companies work alongside company management to develop a workout strategy that makes sense and is able to be executed. If you are struggling to pay off your commercial loan, you.

Source: slideshare.net

Source: slideshare.net

With a commercial loan workout, the borrower has an opportunity to restructure the terms of its debt with willing lenders. Commercial mortgage loan s are specially tailored for purchasing property that can be used for commercial use, the expansion for current business premises, and any residential and commercial investment as well for property development. Our results have literally saved commercial.

Source: slideshare.net

Source: slideshare.net

When a lender is working with a borrower to get a problem commercial loan resolved the loan typically goes to “workout”. Sprentall due to the lender liability litigation fad of the late 1980s and early 1990s, most institutional lenders significantly tightened their documentation, particularly in workouts and restructurings. When a commercial loan is criticized internally, when it’s out of covenant,.

Source: slideshare.net

Source: slideshare.net

If you are struggling to pay off your commercial loan, you may want to consider a commercial loan workout, also known as commercial loan reduction. Management of a residential and commercial distressed real estate loan portfolio handling loans of $100m to $10mm. Now, as temporary modifications come to an end or in other cases, conditions have worsened for borrowers, lenders.

Source: slideshare.net

Source: slideshare.net

Some include the type of lender. We have assembled a team of experienced consultants that specialize in commercial loan workout solutions. Commercial loan workout info thursday, july 8, 2010. With a commercial loan workout, the borrower has an opportunity to restructure the terms of its debt with willing lenders. For property owners who can�t refinance, have a balloon payment coming.

Source: slideshare.net

Source: slideshare.net

Commercial loan workout officer ii. Karen schimpf of commercial capital ltd. When a lender is working with a borrower to get a problem commercial loan resolved the loan typically goes to “workout”. Our results have literally saved commercial property owners from With a commercial loan workout, the borrower has an opportunity to restructure the terms of its debt with willing.

Source: slideshare.net

Source: slideshare.net

Sprentall due to the lender liability litigation fad of the late 1980s and early 1990s, most institutional lenders significantly tightened their documentation, particularly in workouts and restructurings. Now, as temporary modifications come to an end or in other cases, conditions have worsened for borrowers, lenders previously focused on handling paycheck protection program loans are turning concerted attention to managing loan.

Source: slideshare.net

Source: slideshare.net

If your loan covenants require you to submit your interim financials monthly, get them to the bank by the specified date each month. Commercial loan workout officer ii. Not all lenders will participate in a commercial loan workout. The first thing you should know about loan workouts is that it’s important to stay out of the loan workout department if.

Source: slideshare.net

Source: slideshare.net

Why should businesses pursue commercial loan workouts? A successful debt workout strategy can save a deal from an ugly outcome like foreclosure, and saves both parties time and money. Workouts are a plan to get the borrower out of debt and back on track. For property owners who can�t refinance, have a balloon payment coming due, defaulted on their mortgage.

Source: abrigo.com

Source: abrigo.com

Workouts are a plan to get the borrower out of debt and back on track. We have assembled a team of experienced consultants that specialize in commercial loan workout solutions. This refers to the process of working with your lender to come up with a settlement amount that you can afford. With a commercial loan workout, the borrower has an.

Source: slideshare.net

Source: slideshare.net

Commercial loan workout officer ii. Commercial loan workouts helping businesses with commercial loan workouts the balance sheet and cmbs specialists at r.w. That means we work hard to get you results you deserve. A successful debt workout strategy can save a deal from an ugly outcome like foreclosure, and saves both parties time and money. Karen and her team specialize.

Source: slideshare.net

Source: slideshare.net

When a commercial loan is criticized internally, when it’s out of covenant, or when the borrower fails to pay or pays late the loan will often go the workout department of a bank unless the bank uses a special servicer or, at really small banks,. If you are struggling to pay off your commercial loan, you may want to consider.

Source: slideshare.net

Source: slideshare.net

Karen schimpf of commercial capital ltd. Has been in the lending industry since 1989. Put yourself in the place of the loan underwriter. This is why it is essential to retain a commercial loan workout litigation firm that has experience in all aspects of loan workout situations, such as refinancing, loan modification, negotiation, and litigation. Commercial loan workouts from the.